Intel’s First High-Profile IFS Fab Customer: Qualcomm Jumps on Board For 20A Process

by Ryan Smith on July 26, 2021 6:00 PM EST

Alongside Intel’s sizable announcement today regarding their manufacturing roadmap over the next half-decade, the company is also announcing their first major customer for their third-party foundry service, IFS. And in an example of how Intel’s entry into the contract fab business is going to make for some strange bedfellows, it turns out that major customer is Qualcomm.

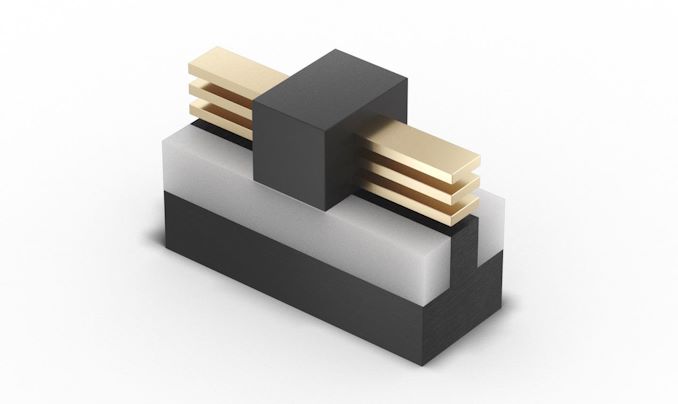

Per Intel’s announcement, Intel and Qualcomm are partnering up to get Qualcomm products on Intel’s 20A process, one of the company’s most advanced (and farthest-out) process node. The first of Intel’s “Ångström” process nodes, 20A is due in 2024 and will be where Intel first implements Gate-All-Around (GAA) transistors, one of the major manufacturing technology milestones on Intel’s new roadmap.

Given that 20A isn’t due out for another three years, neither company is saying much more about the partnership at this point – we’re talking about chip designs that are still in their earliest stages – but even being able to name a major customer like Qualcomm is a big deal for Intel. Not only does it show that another major industry player has a degree of faith in what Intel is trying to accomplish with its silicon lithography technology, but it helps to validate Intel’s efforts to open up into the contract fab business.

Meanwhile, an announcement like this opens the door to all kinds of speculation over just what Qualcomm will be building over at Intel. Qualcomm is best known for their mobile SoCs, and the company already has significant experience using multiple fabs as a customer of both TSMC and Samsung. So it may be that Qualcomm is looking to build a mainstream mobile SoC or two at Intel as a way to get experience working with Intel and prove that Intel’s fabs will meet their needs. Alternatively, Qualcomm may be looking to take advantage of Intel’s PC-tuned manufacturing lines to produce Nuvia-infused laptop SoCs – which would mean Intel would be directly producing competing chips.

There are a lot of possibilities here over the long-run, though in the short-run it’s likely that Qualcomm is going to play things conservatively. So suffice it to say, it will be interesting to see just what Qualcomm is using their rival’s fabs for in a few years.

Qualcomm is excited about the breakthrough RibbonFET and PowerVia technologies coming in Intel 20A. We’re also pleased to have another leading-edge foundry partner enabled by IFS that will help the U.S. fabless industry to bring its products to an onshore manufacturing site.

-Cristiano Amon, President and CEO, Qualcomm

Source: Intel

59 Comments

View All Comments

Spunjji - Wednesday, July 28, 2021 - link

It's accurate, so noSpunjji - Wednesday, July 28, 2021 - link

That's not really how any of this works.arashi - Monday, July 26, 2021 - link

Qualcomm Ericsson RIP.Wereweeb - Tuesday, July 27, 2021 - link

Makes sense. Intel is promising a very power-efficient node. This gives Qualcomm a chance to make some very efficient SoC's.Besides, they're both yank companies, they can try begging for public funds with the justification that this kind of cooperation benefits their country, instead of those dastardly *insert nationality*

mode_13h - Tuesday, July 27, 2021 - link

Yeah, that's a good point. A lot of fuss is made about who builds the communication infrastructure. If you *really* care about that, you might even like to have the chips fabbed domestically. The main point there is probably to ensure a steady supply.FWIW, I made a point of buying a Netgear wifi router. Among other things, it uses a Qualcomm SoC.

flgt - Tuesday, July 27, 2021 - link

This feels like a paid-for press release. A few little R&D projects and no real commitments. Easy money for Qualcomm.mode_13h - Tuesday, July 27, 2021 - link

They're reporting on a press release, so yeah.Blastdoor - Tuesday, July 27, 2021 - link

Even if all Intel had to do to retake the lead is meet their own stated schedule, it would still be very challenging. Possible? Yes, definitely. But challenging. I'd give the a 50-50 chance of meeting their own schedule.But taking the lead means more than just meeting their own schedule -- they need TSMC to also follow Intel's perception of TSMC's schedule. What if TSMC were to parlay their (1) greater economics of scale and (2) greater experience with EUV, and actually beat their current public schedule?

And of course there's the squishy in between, where maybe all the schedules play out as Intel predicts, BUT we end up in a situation where TSMC's yields are great, Intel's suck, and so while Intel technically "retakes the lead" it's with a process that they dare not deploy at volume because they'd lose money.

I'll say this, though... Intel is giving every appearance of doing the right things. Hiring back seasoned engineers and making major commitments to fight hard are all good and necessary. And even if they don't unambiguously retake the lead by 2025, if they are at least competitive, and in a position to maybe retake the lead by 2030 while still being pretty profitable, well -- that's not half bad!

mode_13h - Tuesday, July 27, 2021 - link

Good points. When TSMC releases a roadmap, they are basically initiating talks with customers, which turn into business commitments they have to deliver. So, their confidence level needs to be pretty high, before they announce it. That leaves a reasonable chance they can even surpass it.Intel is playing a different game than they're used to. In the past, their fab roadmaps have been largely aspirational, I think.

> so while Intel technically "retakes the lead" it's with a process that

> they dare not deploy at volume because they'd lose money.

What we saw with 10 nm is they had problems with power, frequency scaling, and yields. The more technical innovations you try to cram into a new process, the more things you have to optimize and the more risk you take on. And, as we've seen, that can take a long time to work through.

> even if they don't unambiguously retake the lead by 2025, if they are at least competitive,

> and in a position to maybe retake the lead by 2030

Wrong article. This is about their foundry business. If they fail to deliver on their roadmap, their own CPU business can survive that, as we've seen. But their foundry business possibly can't.

Blastdoor - Wednesday, July 28, 2021 - link

I think the foundry business can survive being merely competitive, rather than retaking the lead, because they can make price adjustments.But then that brings us to the part of the equation that involves executive bonuses, Wall Street, and internal politics. Will lower margins from a foundry business be tolerated? Or will intel go the route of ibm, and try to grow the bottom line by shrinking costs faster than they shrink revenue?