Intel Reports Q3 2021 Earnings: Client Down, Data Center and IoT Up

by Ryan Smith on October 21, 2021 5:30 PM EST- Posted in

- CPUs

- Intel

- Financial Results

- IFS

Kicking off another earnings season, Intel is once again leading the pack of semiconductor companies in reporting their earnings for the most recent quarter. As the company gets ready to go into the holiday quarter, they are coming off what’s largely been a quiet quarter for the chip maker, as Intel didn’t launch any major products in Q3. Instead, Intel’s most recent quarter has been driven by ongoing sales of existing products, with most of Intel’s business segments seeing broad recoveries or other forms of growth in the last year.

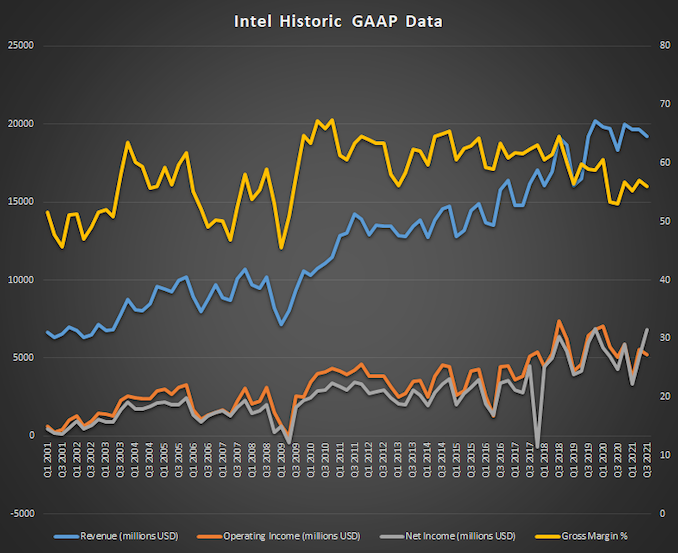

For the third quarter of 2021, Intel reported $19.2B in revenue, a $900M improvement over the year-ago quarter. Intel’s profitability has also continued to grow – even faster than overall revenues – with Intel booking $6.8B in net income for the quarter, dwarfing Q3’2020’s “mere” $4.3B. Unsurprisingly, that net income growth has been fueled in part by higher gross margins; Intel’s overall gross margin for the quarter was 56%, up nearly 3 percentage points from last year.

| Intel Q3 2021 Financial Results (GAAP) | |||||

| Q3'2021 | Q2'2021 | Q3'2020 | |||

| Revenue | $19.2B | $19.7B | $18.3B | ||

| Operating Income | $5.2B | $5.7B | $5.1B | ||

| Net Income | $6.8B | $5.1B | $4.3B | ||

| Gross Margin | 56.0% | 53.3% | 53.1% | ||

| Client Computing Group Revenue | $9.7B | -4% | -2% | ||

| Data Center Group Revenue | $6.5B | flat | +10% | ||

| Internet of Things Group Revenue | $1.0B | +2% | +54% | ||

| Mobileye Revenue | $326M | flat | +39% | ||

| Non-Volatile Memory Solutions Group | $1.1B | flat | -4% | ||

| Programmable Solutions Group | $478M | -2% | +16% | ||

Breaking things down by Intel’s individual business groups, most of Intel’s groups have enjoyed significant growth over the year-ago quarter. The only groups not to report gains are Intel’s Client Computing Group (though this is their largest group) and their Non-Volatile Memory Solutions Group, which Intel is in the process of selling to SK Hynix.

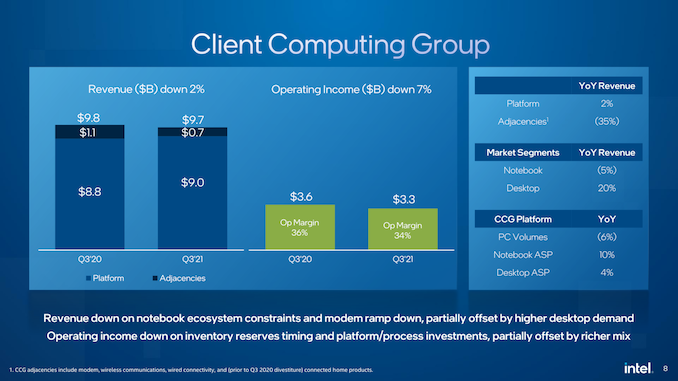

Starting with the CCG then, Intel’s core group is unfortunately also the only one struggling to grow right now. With $9.7B in revenue, it’s down just 2% from Q3’2020, but that’s something that stands out when Intel’s other groups are doing so well. Further breaking down the numbers, platform revenue overall is actually up 2% on the year, but non-platform revenue – “adjacencies” as Intel terms them, such as their modem and wireless communications product lines – are down significantly. On the whole this isn’t too surprising since Intel is in the process of winding down its modem business anyhow as part of that sale to Apple, but it’s an extra drag that Intel could do without.

The bigger thorn in Intel’s side at the moment, according to the company, is the ongoing chip crunch, which has limited laptop sales. With Intel’s OEM partners unable to source enough components to build as many laptops as they’d like, it has the knock-on effect of reducing their CPU orders, even though Intel itself doesn’t seem to be having production issues. The upshot, at least, is that desktop sales are up significantly versus the year-ago quarter, and that average selling prices (ASPs) for both desktop and notebook chips are up.

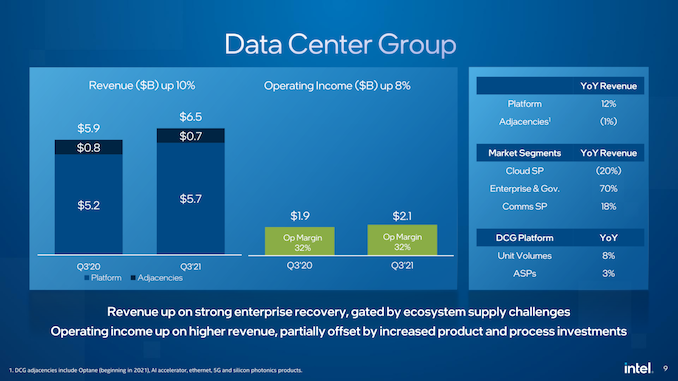

Meanwhile, Intel’s Data Center Group is enjoying a recovery in enterprise spending, pushing revenues higher. DCG’s revenue grew 10% year-over-year, with both sales volume and ASPs increasing by several percent on the back of their Ice Lake Xeon processors. A bit more surprising here is that Intel believes they could be doing even better if not for the chip crunch; higher margin products like servers are typically not impacted as much by these sorts of shortages, since server makers have the means to pay for priority.

Unfortunately, unlike Q2 Intel isn’t providing a quarter-over-quarter (i.e. vs the previous quarter) figures for their earnings presentation. So while overall DCG revenue is flat on a quarterly basis, it sounds like Intel hasn’t really recovered from the hit they took in Q2. Meanwhile, commerntary on Intel's earnings call suggests the sales of the largest (XCC) Ice Lake Xeons has been softer than Intel first expected, which has kept ASP growth down in an otherwise DCG-centric quarter.

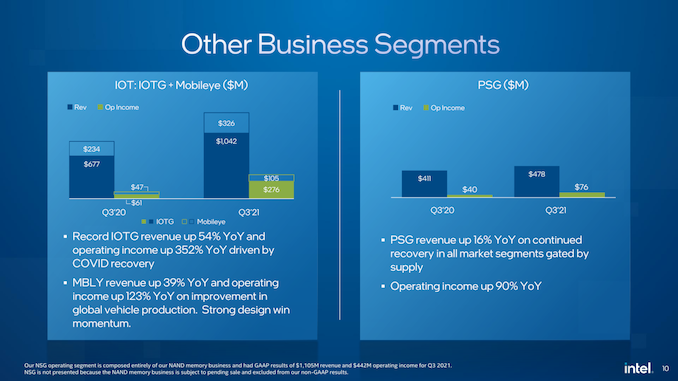

The third quarter was also kind to Intel’s IoT groups and their Programmable Solutions Group. All three groups are up by double-digit percentages on a YoY basis, particularly the Internet of Things Group (IoTG), which is up 54%. According to Intel, that IOTG growth is largely due to businesses recovering from the pandemic, with a similar story for the Mobileye group thanks to automotive production having ramped back up versus its 2020 lows.

Otherwise, Intel’s final group, the Non-Volatile Memory Solutions Group, was the other declining group for the quarter. At this point Intel has officially excised the group’s figures from their non-GAAP reporting, and while they’re still required to report those figures in GAAP reports, they aren’t further commenting on a business that will soon no longer be theirs.

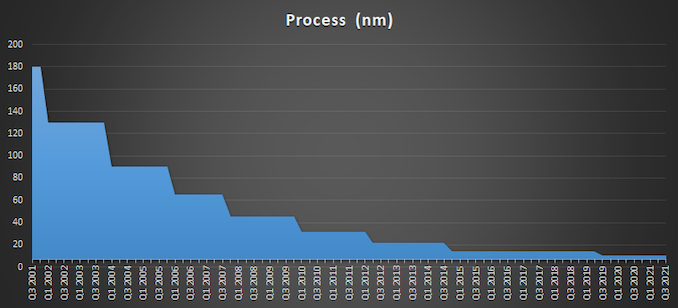

Finally, tucked inside Intel’s presentation deck is an interesting note: Intel Foundry Services (IFS) has shipped its first revenue wafers. Intel is, of course, betting heavily on IFS becoming a cornerstone of its overall chip-making business in the future as part of its IDM 2.0 strategy, so shipping customers’ chips for revenue is an important first step in that process. Intel has laid out a very aggressive process roadmap leading up to 20A in 2024, and IFS’s success will hinge on whether they can hit those manufacture ring technology targets.

For Intel, Q3’2021 was overall a decent quarter for the group – though what’s decent is relative. With the DCG, IOTG, and Mobileye groups all setting revenue records for the quarter (and for IOTG, overall records), Intel continues to grow. On the flip side, however, Intel missed their own revenue projections for the quarter by around $100M, so in that respect they’ve come in below where they intended to be. And judging from the 7% drop in the stock price during after-hours trading, investors are taking note.

Looking forward, Intel is going into the all-important Q4 holiday sales period, typically their biggest quarter of the year. At this point the company is projecting that it will book $18.3B in non-GAAP revenue (excluding NSG), which would be a decline of 5% versus Q4’2020. Similarly, the company is expecting gross margins to come back down a bit, forecasting a 53.5% margin for the quarter. On the product front, Q4 will see the launch of the company’s Alder Lake family of processors, though initial CPU launches and their relatively low volumes tend not to move the needle too much.

On that note, Intel’s Innovation event is scheduled to take place next week, on the 27th and 28th. The two day event is a successor-of-sorts to Intel’s IDF program, and we should find out more about the Alder Lake architecture and Intel’s specific product plans at that time.

Source: Intel

32 Comments

View All Comments

edzieba - Saturday, October 23, 2021 - link

Intel's profits are not plateauing, nor declining, and this is the trend that has continued for over two decades. That demonstrates that, just maybe, their thinking has indeed been 'long term'.Or possibly, those profits are entirely imaginary and internet pundits know better than Intel's own staff.

Blastdoor - Saturday, October 23, 2021 - link

Intel's own staff know and knew better than Team Complacency that Intel was (and is) in trouble.Gelsinger seems to have the right idea for turning things around. He's got a shot -- the timing of the chip shortage has worked out very nicely for Intel, Intel is still making plenty of money, the US government seems very supportive, etc.

Sivar - Friday, October 22, 2021 - link

Wall Street often rewards R&D when the company shows results. Look at Tesla's valuation, and that they spend a greater percent of revenue on R&D than other autos, by far.Intel has a history of large and expensive failures. This isn't necessarily a bad thing as they are a company that takes a lot of risks as part of their culture, but their success rate and follow-through rate can use some improvement.

- Larrabee, one of the dumbest ideas in semiconductor history (x86 cores as a GPU?!), not only cost a fortune, but delayed their next-gen process, according to a co-worker who was on the team.

- Itanium

- 10nm process

- Optane (we'll miss you!)

- RealSense

romrunning - Friday, October 22, 2021 - link

Hey, Optane could have been a success, if they stuck with it. It was already a technical success, but it didn't reach the scale to become profitable. I find it ironic on Intel's part that they are dumping a great tech, which potentially could have become the replacement for all current NAND flash SSDs, just because it didn't pay off right away. They are selling basically the foundry for making the Optane which now seems at odds with the current push to get *more* foundry work (granted, immediate revenue from clients).How well is that paying off for GloFlo? They could have been on the leading edge with TSMC right now if they had stuck it out. Right now they benefit from the shortages, but long-term, how much more profitable they could be!

name99 - Friday, October 22, 2021 - link

More precisely, Optane could maybe have been a success if they treated it as building out an ecosystem. That means providing support for it in EVERY SoC they ship.Instead, like every innovation of their's over the past fifteen years, they treated is as something they could charge an arm and a leg for, and get those suckers in Enterprise to pay for it.

And so things played out exactly as expected. Minority feature, barely no-one experimented with it, no innovative use cases (like putting it into laptops, that can then hibernate and recover from hibernation very aggressively -- think the speed of an iPad going to sleep and waking).

Same thing with AVX512 -- keep it limited to the high end, no-one bothers to write code for it, end result is no-one even gives a damn whether or not it's present in Alder Lake. Very different story from the rollouts of everything from MMX up to AVX2, back in the days when Intel understood the value of giving up rents today for the sake of building the ecosystem.

whatthe123 - Friday, October 22, 2021 - link

they "rewarded" tesla with a low valuation until it blew up last year, what are you talking about? it was 10 years of constant complaints about their R&D spending and lack of profit.Oxford Guy - Sunday, October 24, 2021 - link

1. Sell less for more2. Copy someone else's R&D

ammaterasu - Friday, October 22, 2021 - link

"Wall Street hates investments in r&d, manufacturing, and lower margin businesses"What about TSM that's spending 100bn in 3 years? It's a wallstreet darling now. what about those bunch of SaaS names that burns lots of money yet trades at 10x sales??

"will Wall Street let him save Intel? "

Wall Street is not an obstacle to INTC. Gellsinger can still save INTC if the stock price goes to $1. Similarly stock price can go to $150, but Gellsinger still fails to execute and fall further behind

name99 - Friday, October 22, 2021 - link

"Stock is down 10%" is a fact."because Wall Street hates investments in r&d, manufacturing" is your theory.

Wall Street is happy to invest such money in Apple or TSMC (huge R&D investment), Tesla (manufacturing), Amazon (low margin).

Perhaps the problem is not with Wall Street but with Intel? Here's another theory:

"because Intel gave the same song and dance about next year it will be awesome, super CPUs, super GPUs, super new process, just you wait" that they have been giving since Broadwell delays. And while fans may still be fooled, professional investors have lost patience with a company whose primary competence right now appears to be slideware about what they will be doing ten years from now".

Blastdoor - Saturday, October 23, 2021 - link

Until the last few years Apple was consistently undervalued by Wall Street, but Steve Jobs had total immunity to Wall Street pressure because he literally saved the company and had total loyalty from employees and his hand picked board. That's a very unusual situation.Bezos and Musk are also very unusual -- founders who managed to do whatever they wanted. Often Wall Street didn't like it, but it didn't matter.

As a more established firm, with founders long departed, Intel fell under more traditional Wall Street control. They had a board and CEO focused on quarterly profit. They curtailed investment in fabs, laid off experienced engineers, and famously refused to fab the iPhone SOC. Those moves pumped up the bottom line in the short term, executives got their bonuses. And now here we are.